Document Details

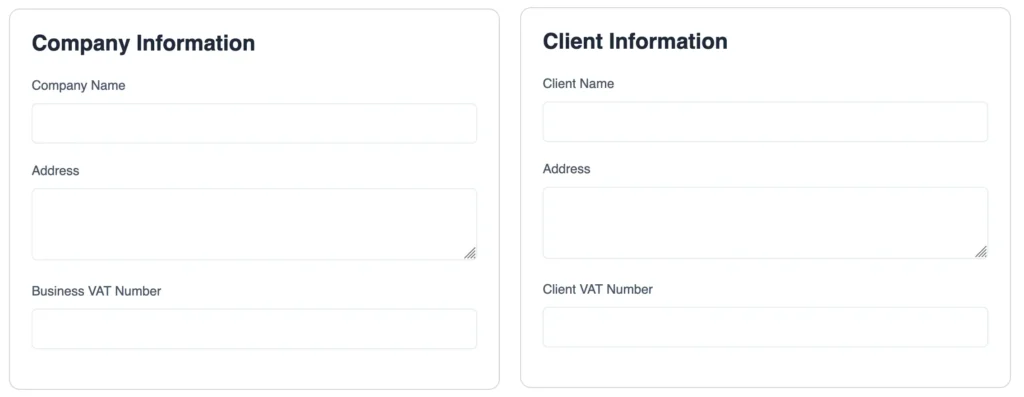

Company Information

Client Information

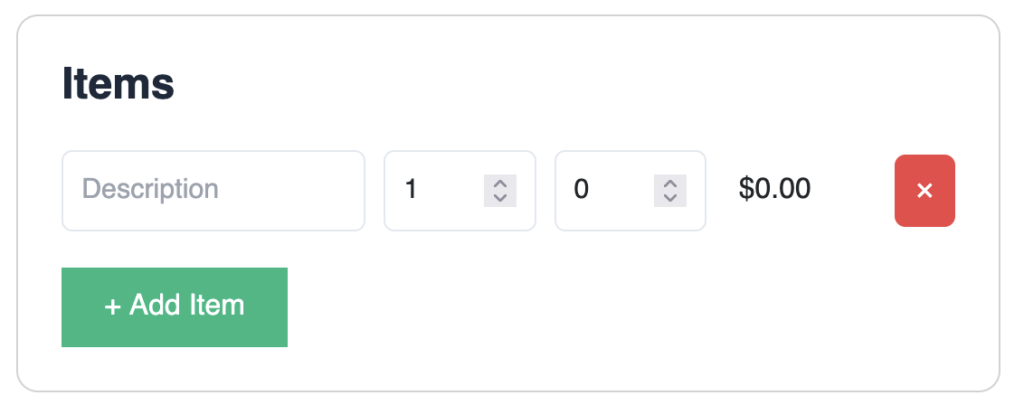

Items

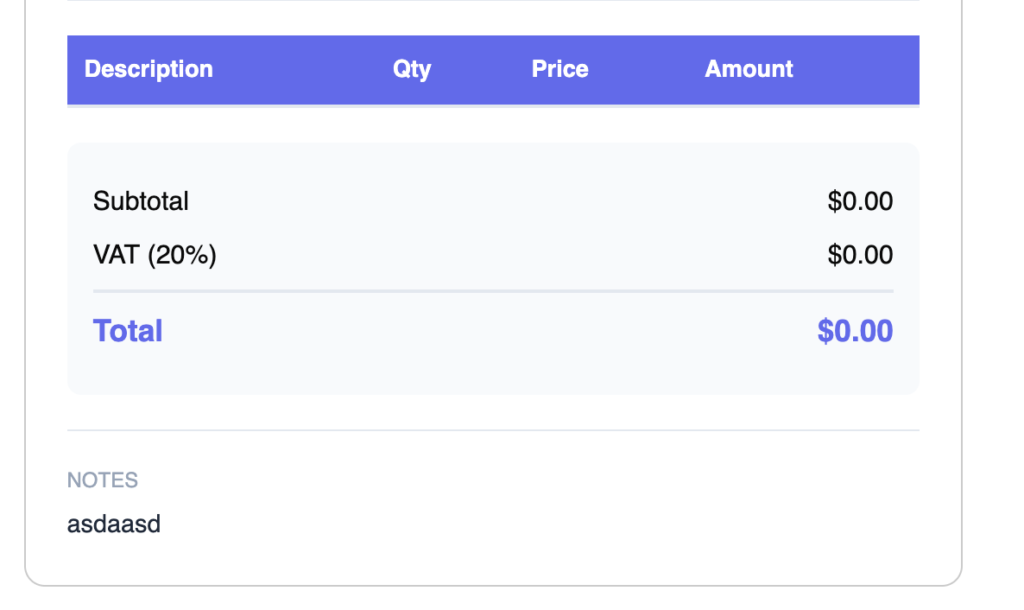

| Description | Qty | Price | Amount |

|---|

A proforma invoice provides clarity and transparency before a sale by outlining estimated costs, quantities, and terms, allowing buyers to review pricing and approve transactions with confidence.

| Description | Qty | Price | Amount |

|---|

A proforma invoice is a preliminary billing document sent to a buyer before the actual sale takes place. It provides a clear estimate of the goods or services to be delivered, including prices, quantities, taxes, and other important terms. Businesses use proforma invoices to communicate costs upfront and avoid misunderstandings later.

Unlike a final invoice, a proforma invoice does not demand payment. Instead, it acts as a formal quotation that helps both the buyer and seller agree on the transaction details before proceeding.

A proforma invoice is an advance document issued before delivering goods or services. It outlines what the final invoice will look like once the transaction is completed. Because of this, proforma invoices are widely used in trade, exports, service agreements, and custom orders.

Although it resembles a regular invoice in format, a proforma invoice is not legally considered a tax invoice and does not record revenue.

Proforma invoices help businesses set expectations clearly. They allow buyers to review pricing, approve budgets, or arrange payments in advance. This is especially helpful when dealing with new clients, large orders, or international transactions.

| Aspect | Proforma Invoice | Final Invoice |

|---|---|---|

| Purpose | Provides an estimate or quotation | Requests payment |

| Payment Demand | No | Yes |

| Legal Status | Not a tax document | Legally valid for accounting |

| Revenue Entry | Not recorded | Recorded in accounts |

| Usage Stage | Before sale or delivery | After sale or delivery |

A well-prepared proforma invoice contains most of the details found in a final invoice, except for legal tax compliance elements. Including clear and complete information helps avoid confusion and speeds up approvals.

Proforma invoices are most useful when pricing needs approval before work begins. They are commonly used in international trade, service contracts, and large custom orders where costs must be confirmed upfront.

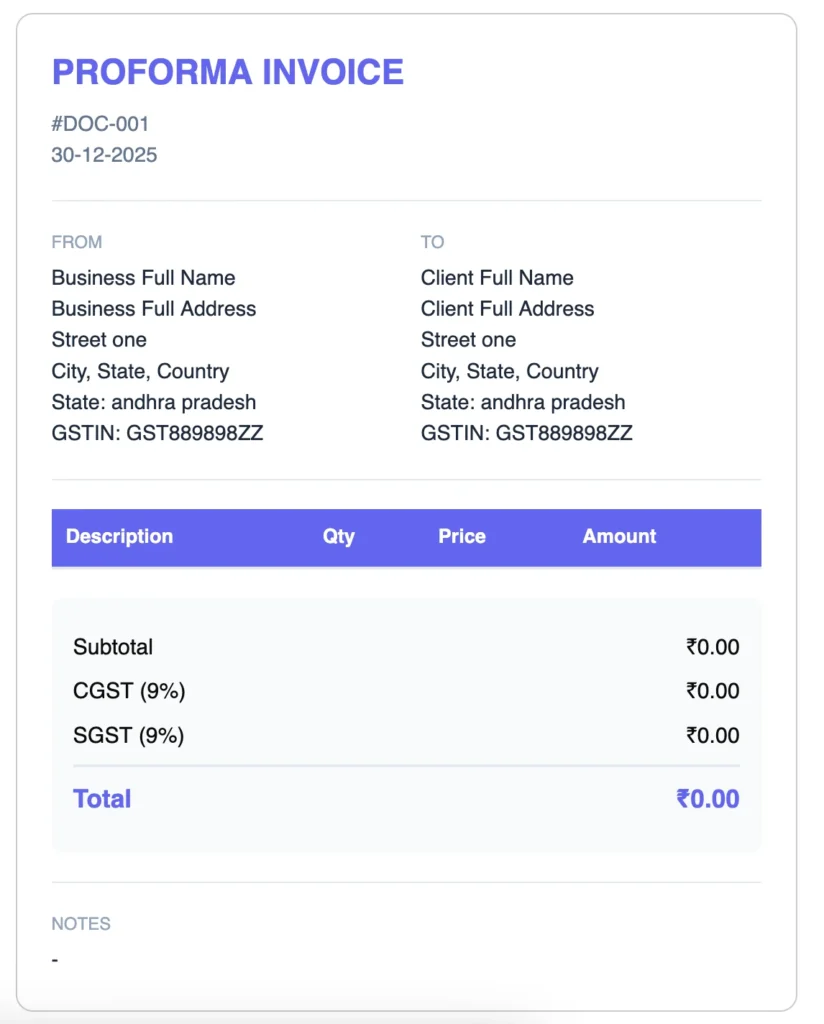

Enter your company information and customer’s name, addresses, and tax information clearly.

Describe the goods or services, including quantity and pricings.

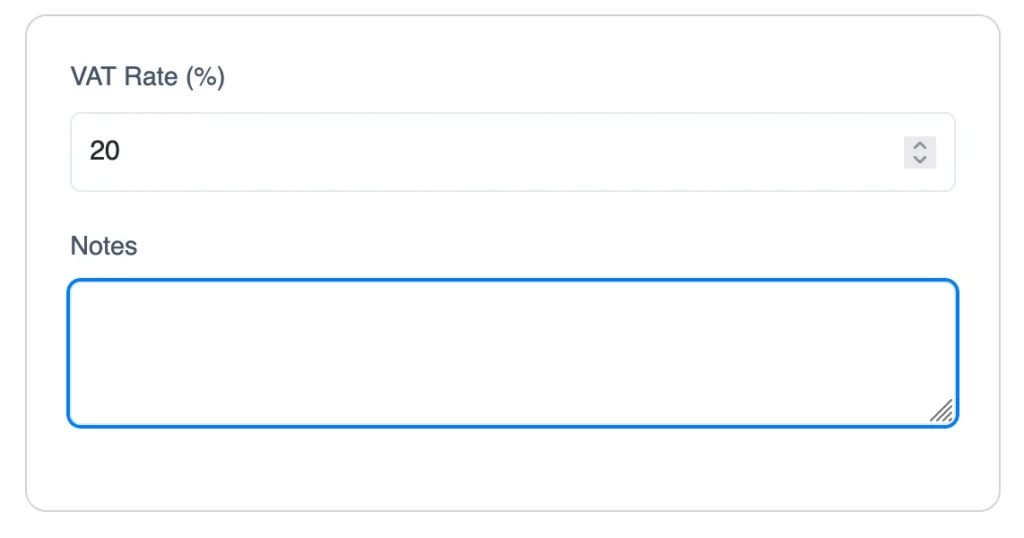

The tool will auto calculate subtotals, estimated taxes, and the total payable amount for reference.

Include delivery timelines, payment terms, and a note stating that the document is a proforma invoice.

The tool will auto generate the proforma invoice preview. Double-check all details before sending the proforma invoice to the client for approval.

From an accounting perspective, a proforma invoice does not impact financial statements. It does not record income, tax liability, or receivables. Only the final invoice affects accounting records once the transaction is completed.

However, proforma invoices remain useful for planning, forecasting, and documentation.

A proforma invoice is a preliminary document that outlines estimated charges before a sale or service is completed.

The purpose of a proforma invoice is to inform the buyer of costs and terms in advance.

A proforma invoice is not legally binding and does not demand payment.

It is usually used for reference or advance approval, not as a final payment request.

A proforma invoice is similar to a quotation but is more detailed and formatted like an invoice.

A proforma invoice plays an important role in setting expectations before a sale is finalized. By clearly outlining estimated costs, quantities, and terms in advance, it helps businesses maintain transparency and allows buyers to review and approve transactions with confidence. Using the right invoicing tool makes this process faster, more accurate, and easier to manage.

To create professional invoices quickly and without complexity, you can also use OmniTools’ free online invoice generator, which helps you generate professional invoices directly from your browser while keeping your data private and secure.

Tips, guides and tutorials to help you get the most out of our tools